Creating value at every step of the investment cycle

We support Private Equity clients with advisory services, including Digital, Data and Tech Due Diligence and Digital Strategy creation to assess risk and opportunities in target investments. Our 150+ delivery teams also help portfolio companies implement their digital transformation strategy at pace, realise the vision of the IM and maximise exit value.

Services that create more value for Private Equity

PE Services

Buy-side

Technology Due Diligence

Gain a comprehensive understanding of investment risks and unlock value with our reliable technology due diligence. Trusted by leading mid-market private equity firms globally, we help you assess opportunities swiftly and efficiently. We have a robust framework in place to assess the technical health of a target business, and we focus our technology scope items around each specific transaction and investment thesis.

Buy-side

Digital Due Diligence

The rapid growth of digital business models and online-based enterprises means that investors need more clarity on a target's digital acumen. Moreover, traditional companies are also embracing digital transformation, whether to seize fresh value opportunities or shield themselves from digital competitors. We provide investment directors, value creation teams and investment committees with insightful reports that add strategic value from the get-go. Our experienced digital team can cover all aspects of customer attribution modelling, CAC, CLTV, and ROAS assessments , as well as strategic marketing assessments.

Sell-Side

Vendor Technology & Digital Due Diligence

Get an in-depth assessment of your technology and inspire investor confidence. Our Vendor Due Diligence assessment highlights risks before they get flagged in buy-side assessments, helping to avoid any surprises and fundraise with confidence. Our advisory team can reveal unidentified risks that could hurt your valuation or even stop an exit dead in its tracks. We identify technical risks and provide the guidance you need to remedy them ahead of investor analysis and buy-side activity.

Value Creation

Digital Strategy & Roadmap

We work with PE houses and portfolio management teams to create transformational Digital Strategies as part of wider Value Creation Plans. We have a two-phase approach: the initial 'Assess' stage evaluates your current digital maturity, capabilities and initiatives as well as helps our expert team understand exactly where you want to be. In the 'Create' phase that follows, we build an actionable and costed 24-36 month Digital Strategy. Equator can also assist in the delivery when required.

Value Creation

Digital Transformation

Equator has delivered digital transformation projects for PE-backed businesses over the last 25 years. Your portfolio companies may have stretched management and operational teams that need to be up-skilled and the pace of change ramped up. Our 180+ digital experts and best-practice development processes support you from the get-go to create integrated transformation throughout an organisation. We align operational effectiveness with customer experiences across the full customer lifecycle.

Value creation

Interim C-suite roles

Equator's interim C-suite services provide more than a temporary solution for your technology leadership needs. Our fractional CTOs, CPOs, and CISOs nurture your team’s development and drive delivery velocity during the transition period. Ultimately, they ensure the business is left stronger, with a legacy of best practices to propel you forward.

Essential to assess value, risk and upside potential.

Diligence & Advisory Services

With digital and disruptive technology changing so fast and impacting business in more fundamental ways, the health of a company’s digital ecosystem can have a profound bearing on value as well as future upside. Companies’ digital practices, including how customer information is managed, and how transparent they are can significantly impact overall value which can result in steep fines and reputational damage.

Clear, actionable insights

Reporting

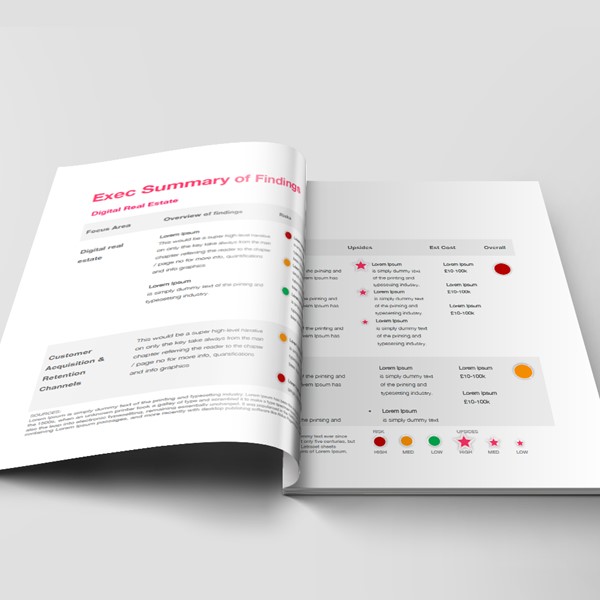

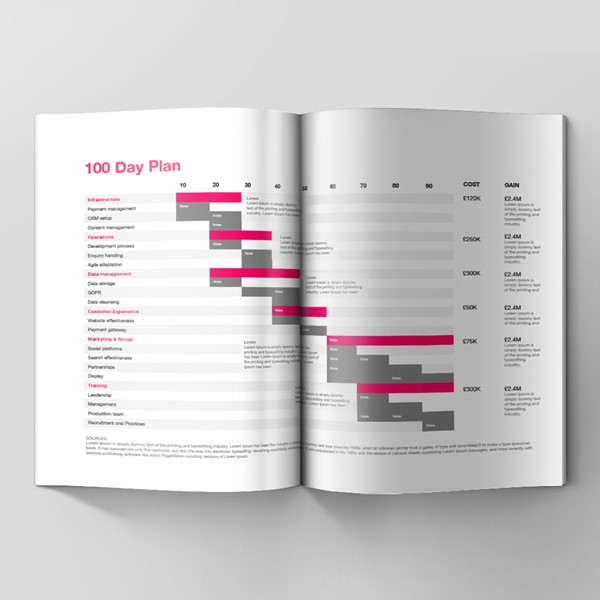

We recognise the importance of providing you with a clear, easily digestible report that tells you exactly what you need to know to assess the digital maturity of your target company. You will find our report simple to navigate, with a concise Executive Summary, visual illustration of the digital landscape and a clear set of risks with remedial actions. We also provide an actionable 100-day plan that we can help you deliver.

Overview

Easy to use Exec Summary

The clear, concise Exec Summary shows you everything you need to know at a glance. It includes R-A-G rated observations, actionable recommendations, and cost estimates.

Image for illustration purposes only.

Visual Map

Inventory of the Digital Landscape

We map out the digital estate in detail so you know what you have and where the challenges are.

Image for illustration purposes only.

Environment

Marketplace & competitor review

We review the competitors and the market to identify potential disruptors or digital changes that may effect business status.

Image for illustration purposes only.

Action

Suggested 100-day plan

Our 100-day plan gives clear guidance for timing and prioritisation to achieve recommended actions cost-efficiently.

Image for illustration purposes only.

PE Clients

Experience

We support a range of PE houses in the UK, EU and North America