It's hard to cut through the noise

As an insurance provider, it can be hard to cut through the noise and find relevance in a business built on an aversion to risk and protecting customers. But within that customer base, you’ll find the trends that matter, trends that can unveil the changes that can bring new opportunities and the multitude of threats to current business models, seen as traditional and staid. The insurance industry needs to prepare.

"Almost every insurer now finds the majority of their car, home and life business comes from aggregators"

If there’s one cataclysmic change that has defined the insurance industry over the last decade, it’s aggregation.

Almost every insurer now finds the majority of their car, home and life business comes from aggregators. While this provides a steady flow of new business, it has also commoditised the sector, slashed margins, un-branded the purchase process and demands an ever-larger commission. The benefits are scant and most insurers you speak to will say they wish they’d never gone down that road in the first place.

Aggregation drove commonality of offering, comparability of products, features and services. And this might mean we can turn on the sales tap at will, but it is slowly destroying the efforts brands like AXA, Aviva and RSA have put in over the years to deliver remarkable service, build strong brands and create loyalty. In a world where consumers are likely not claiming in any given year, aggregators can easily tempt you away to cheaper options where neither the service nor the brand matter.

So, how can insurers exploit technology to claw back some control?

It's all in the data

So, how can insurers exploit technology to claw back some control? It is all in the data – establishing a deeper, more personalised customer relationship and offering products and services so customised that it becomes impossible to compare your offering to someone else’s.

This has only recently become possible thanks to advances in a few key technology areas. Firstly, with genuinely Cloud-driven data storage powered by companies like Google, Microsoft and IBM, the promise of the true single customer view is now within reach. Previously, the idea of tying an insurer’s multitude of legacy systems into one “controlling mind” was not only technically out of reach, it was often untenable for even the most enthusiastic CTO’s budget. Increased competition has resulted in rapidly falling costs and ever-improving internet connectivity, making this a tangible reality.

Having all your data in one place is not the cure-all of course, as many “Big Data” early adopters will have discovered to their chagrin. What now makes this move far more lucrative is Machine Learning (ML). Until recently, identifying the patterns in customer data that indicated loyalty, up-spend, fraud, lapsing and other behaviours mined on a trial and improvement basis. Now, by using predictive learning techniques across an insurer’s entire database, we can understand the propensities of customers, even when they have only limited behavioural and finance data on their record. Here at Equator, we’re also using ML techniques to establish demographic and behavioural propensities from how a user engaged with a website and its purchase funnel – a cutting edge technological approach which was not possible 18 months ago. In short, data mountains are becoming manageable molehills for marketers, claims adjustors and product managers alike.

"The insurer that makes a move to ML-powered personalisation has a long-term strategic advantage"

Satisfying customer demand for personalised experiences

When you understand your customers better, it becomes far easier to offer product and service customisations that are relevant to that individual. Ones that perhaps lower their renewal cost but, more importantly, deepen their relationship with you and make it harder, or indeed impossible, to aggregate.

The insurer that makes a move to ML-powered personalisation has a long-term strategic advantage over those that do not. This demonstrates that no matter what InsurTech startup comes along, the power lies with those who sit on top of data mountains and have the tools and capabilities to mine it.

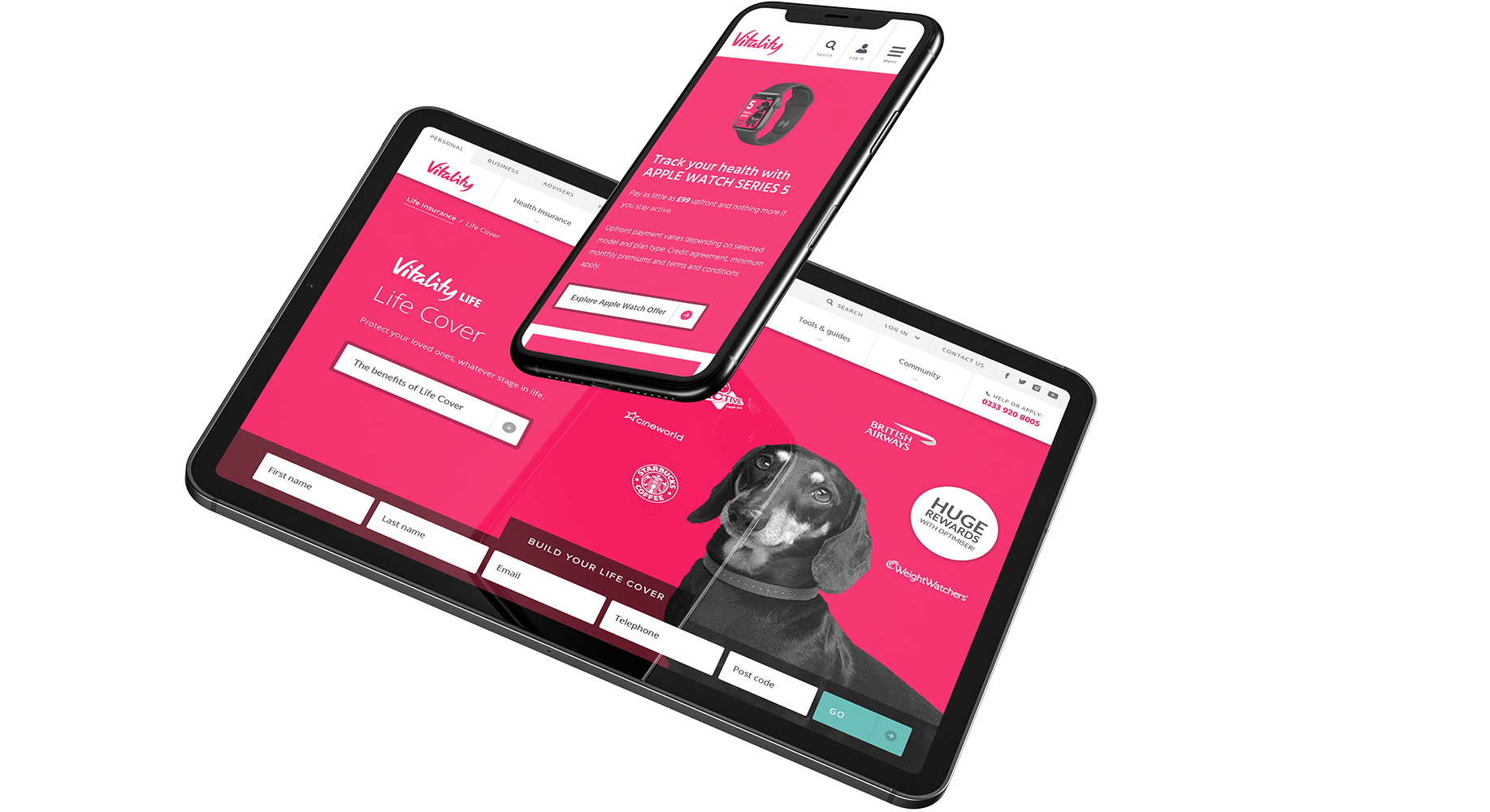

In the last few years, we’ve worked with many major insurance brands to help them take on tomorrow by innovating to bring new products and services to life. We helped AXA innovate their customer acquisition and claims journeys, as well as personalisation of services. With Vitality, we helped break the back of their tech infrastructure, allowing them to improve their personalisation capabilities. That’s not it either, there’s a dozen other insurance brands, who have received the same digital transformation treatment.

But the industry has a long way to go

Many insurers still see the move to bring their data together under one Cloud-based roof as impossible, often citing regulatory or risk reasons - something their smarter competitors are overcoming. This is where you employ the external services of those skilled in digital transformation. Those that have been there before and can navigate the technological hurdles while appreciating the compliance and legal difficulties you will face internally.