Challenge

Black Horse Finance’s growth relied on a small number of large dealership groups, limiting market reach. To scale, they needed to engage mid-tier dealers - many with inconsistent digital capabilities, legacy systems, and limited marketing sophistication.

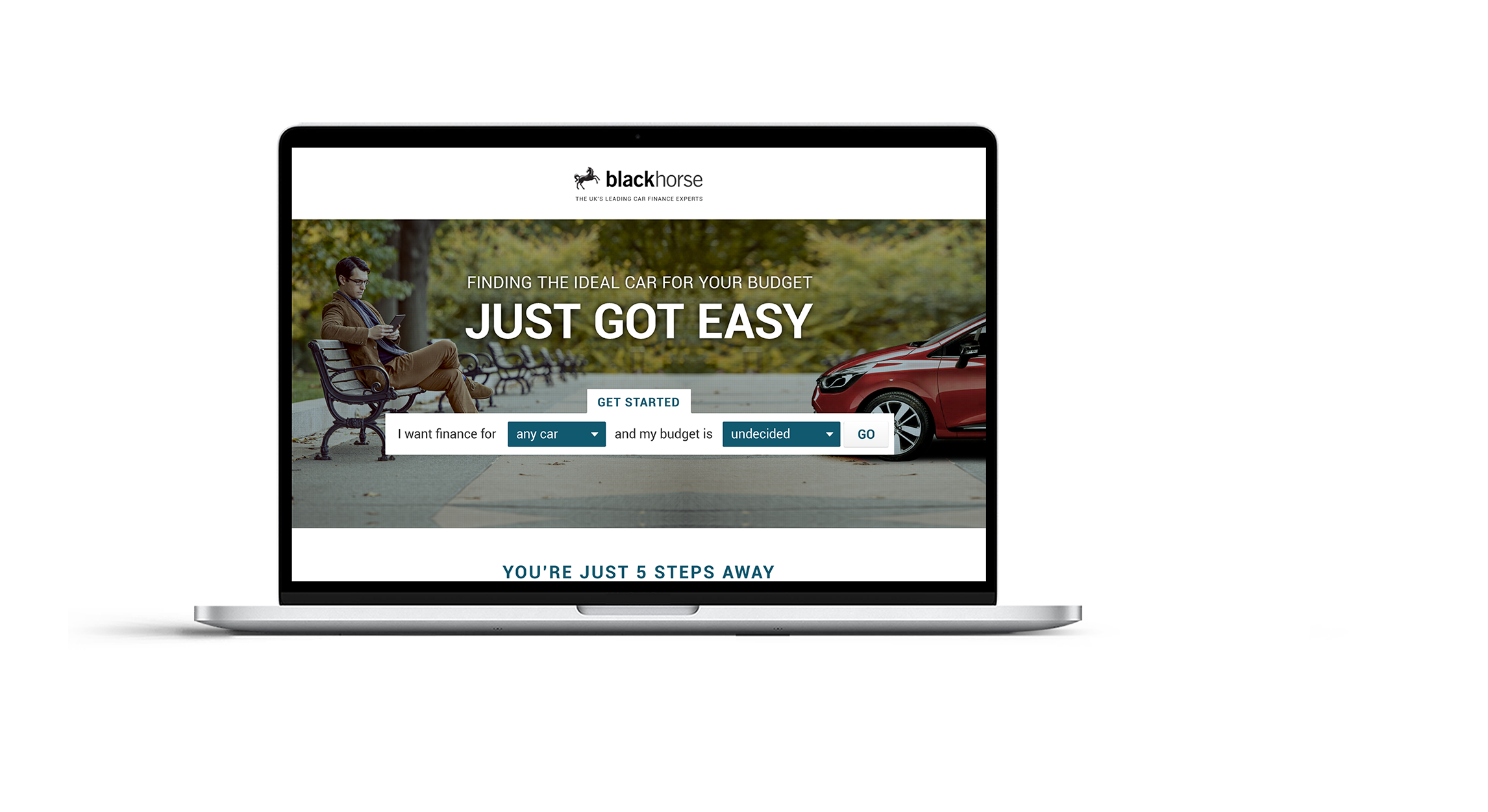

The brief was to create a tech-agnostic, low-maintenance, direct-to-consumer platform that could reduce onboarding friction, build trust, and unlock market expansion without increasing operational complexity.

Do you have a similar challenge?

Please get in touch to start a conversation about how our expertise can help your business thrive.

Solution

We designed and delivered the ‘Finance Passport’ – a mobile-first, pre-approval experience that empowered customers to explore, apply, and secure car finance before entering a dealership.

- Introduced a “loan-on-your-phone” model that simplified eligibility and accelerated purchase intent.

- Applied service design and UX strategy to create a seamless, data-driven journey that integrated easily into existing dealer systems.

- Focused on scalability – a flexible design and integration layer enabled rollout across multiple business units.

Capabilities

Service Design

CX & UX

Process Engineering

Rapid Prototyping

System Integration

Results

32% increase in lead generation

“The results more than exceeded our growth target.” – Chris Humphreys, Digital Lead, Black Horse Finance