Challenge

Embark Group is one of the UK’s largest retirement solutions providers, managing around £40 billion in assets.

Its core adviser platform was over 15 years old and built around data rather than user experience. While existing users had adapted, onboarding new advisers and partners was high risk. A piecemeal upgrade wouldn’t support Embark’s long-term ambitions, including white-labelling and rapid partner growth.

Do you have a similar challenge?

Please get in touch to start a conversation about how our expertise can help your business thrive.

Solution

Equator was appointed as the lead digital partner to deliver a full platform transformation.

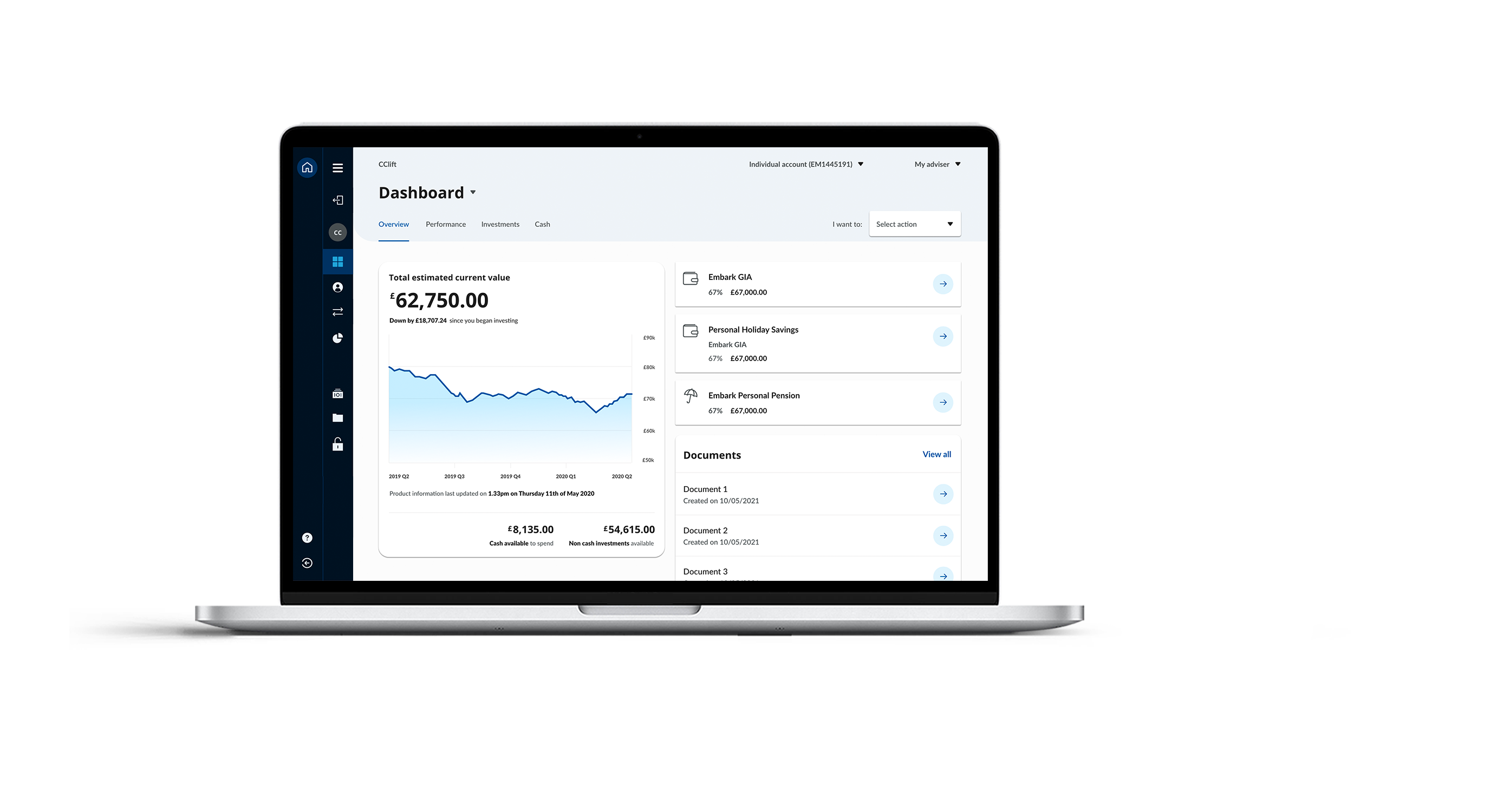

We formed an augmented transformation team and redesigned the experience end-to-end, ensuring CX, UX, and UI were integrated throughout the delivery process. The focus was on

creating a configurable, secure, and future-proof platform for advisers, paraplanners, and end customers, considering the limitations of the FNZ platform.

- Reframed the brief to encompass a comprehensive experience across the entire platform, rather than a limited set of journeys.

- Created dual experiences within one application for advisers and customers.

- Developed shared code with role-based journeys to optimise efficiency and personalisation.

- Implemented Umbraco to manage content and support white-label partners. Integrated via APIs with core business systems and the data warehouse.

- Delivered on secure, scalable cloud infrastructure.

Delivery Approach

- Introduced gold and silver design sprints to balance speed and complexity

- Used rapid prototyping and user testing for complex journeys

- Applied agile delivery for lower-complexity features using a modular design system

Results

- Modernised a 15-year legacy platform without disrupting day-to-day operations

- Improved onboarding, usability, and confidence for advisers and partners

- Created a scalable platform ready for acquisition and long-term growth

Outcome

The transformed platform supported Embark’s sale to Lloyds Banking Group for £400 million and now forms the core of the digital platform powering Scottish Widows. It serves as a clear example of how experience-led, future-proof digital transformation directly drives enterprise value and successful exit.